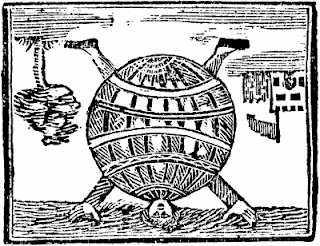

The World Turned Upside Down

There is a story, possibly true, that when the British surrendered to American and French forces at Yorktown, effectively ending British rule of America, someone in the British army sang or played an old English folk song, “The World Turned Upside Down.” (See https://en.wikipedia.org/wiki/The_World_Turned_Upside_Down ) I think I know how the British felt. Many of the assumptions economists have made about economic reality and economic policies now seem out-of-date or even reversed. UNITED STATES The Fed fought inflation; now it sets inflation targets when there is no inflation. The Fed worries about deflation even though the major source is a fall in energy and commodity prices. Another source is the fall in the prices of technology products. There is a large increase in the money supply, large government deficits, a large trade deficit, and a large decrease in the unemployment rate. Economic theory and past experience says that there should...