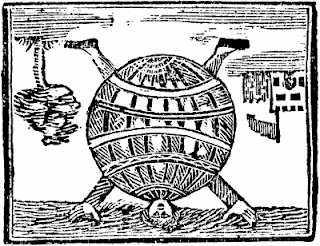

The World Turned Upside Down: The Uselessness of Conventional Economic Wisdom

There is a story, possibly true,

that when the British surrendered to American and French forces at Yorktown,

effectively ending British rule of America, someone in the British army sang or

played an old English folk song, “The World Turned Upside Down.” (See https://en.wikipedia.org/wiki/The_World_Turned_Upside_Down)

I think I know how the British felt. Many of the assumptions economists have made about

economic reality and economic policies now seem out-of-date or even reversed.

UNITED STATES

The Fed fought inflation; now it

sets inflation targets when there is no inflation.

The Fed worries about deflation even

though the major source is a fall in energy and commodity prices. Another source is the fall in the prices of technology products.

There is a large increase in the money supply, large government deficits, a large trade deficit, and a large decrease in the unemployment rate. Economic theory and past experience says that there should be an increasing inflation rate. There isn't.

There is a large increase in the money supply, large government deficits, a large trade deficit, and a large decrease in the unemployment rate. Economic theory and past experience says that there should be an increasing inflation rate. There isn't.

America is experiencing a long

period of real economic growth without inflation. Unemployment is as low as realistically

possible. Rather than rejoicing,

economic, business and political commentators seem to believe there is

something fundamentally wrong with this.

Since the end of World War II, a key

part of American foreign policy has been the expansion of free trade. Now presidential candidates of both parties,

and over half the American people, want to reverse free trade. Economic nationalism is rising at the same

time as large American corporations are about to receive over half their sales

and profits from overseas operations.

America worried about importing too

much oil; now America is worried about producing too much oil.

Interest rates are important because

they are the price of capital, which determines how capital is allocated. Now interest rates are a policy tool of the

Fed. They are artificially low with no

thought about how they are affecting capital allocation.

The stock market was a place where

companies went to raise new capital.

Now, through massive share buybacks, it is a place where companies

reduce equity capital.

It has been government policy that

annual budget deficits are manageable as long as the national debt-to-nominal

GDP ratio was low. That is, as long as

the national debt rose at a lower rate than nominal GDP. But since 2008, the national debt has risen

much faster than nominal GDP. We are

experiencing historically high and rising peacetime national debt-to-GDP ratios. So far, there has been little consequence

because of historically low interest rates.

If nominal interest rates rise, there will be larger budget deficits.

Seven years into a recovery interest

rates and inflation rates should be rising.

No one could conceive that central banks in the U.S., Europe, Japan and

other countries would set zero short-term interest rates this far into the

recovery.

Negative interest rates, both real

and nominal, were considered possible but not realistic. Most industrialized countries have had some

negative interest rates.

The Fed stopped looking at the

increase in the money supply as a policy tool about 30 years ago. Now a huge increase in the money supply is

being used to finance a huge increase in the national debt.

Tax cuts and a larger deficit are traditional tools to fight a recession. They are being advocated as sound fiscal policy at the top of a business cycle.

Tax cuts and a larger deficit are traditional tools to fight a recession. They are being advocated as sound fiscal policy at the top of a business cycle.

An economy can be in recession if

private spending is too low (inadequate private aggregate demand). This implies private saving is too high. The solution is that government spending

should be increased and/or taxes lowered.

The result is a larger government deficit, which is financed by private

saving. But with structural deficits at the

national and state levels, private saving now has to be high to finance

government deficits. Also, the United States has to continue to take in a high percent of cross-border financial flows.

CHINA

By some measures, using purchasing

price parity (PPP) measurement, the Chinese economy is as big or possibly

larger than the American economy.

(Although many analysts believe the past growth rates and the real

economy of China are overstated.)

China has over half of the world’s

high-speed railroad trackage and intends to increase it by two-thirds over the

next 10 years. By 2025, China intends to

have every city in China with a population of at least a half a million to be

connected to the high-speed rail network.

The point? China spends substantially

more on infrastructure than the United States does, and China uses more

advanced technology.

The U.S. high-speed rail

mileage? Zero. Japan has offered to give the U.S. its

high-speed rail technology. I think

that’s called foreign aid.

China is planning a high-speed

railroad that will take passengers and freight from Beijing to Moscow in 33

hours and London in 48 hours. Some

sections of the railroad have already been built. The geopolitical idea is to bypass American

control of the world’s shipping lanes.

China has four times as many

skyscrapers as the United States.

China has most of the long and high bridges in the world.

China has most of the long and high bridges in the world.

China has more cars than the United

States. China has more smartphones.

China produces most of the world's solar panels. On the other hand, China emits more carbon into the atmosphere than any other country.

China produces most of the world's solar panels. On the other hand, China emits more carbon into the atmosphere than any other country.

GLOBAL

Recessions were caused by rising

global commodity prices. Now there is a

fear that a global recession could be caused by falling commodity prices and

their longer-term consequences.

In the post-WWII period, there had

never been a global recession. Until

2007-2009.

At Japan's current rate of economic growth, their economy will double in size in 100 years. But by then there will be very few, if any, Japanese.

Almost all countries are experiencing rapidly rising national debt-to-nominal GDP ratios. Economic history indicates bad things start to happen if the ratio goes over 90%. Many countries, including the U.S., are over 100%. Japan has the highest ratio at 230%, a ratio no one thought could be possible without catastrophic economic consequences. But this high and rising ratio is made possible because Japanese families are apparently willing to lend their government unlimited funds at zero interest.

At Japan's current rate of economic growth, their economy will double in size in 100 years. But by then there will be very few, if any, Japanese.

Almost all countries are experiencing rapidly rising national debt-to-nominal GDP ratios. Economic history indicates bad things start to happen if the ratio goes over 90%. Many countries, including the U.S., are over 100%. Japan has the highest ratio at 230%, a ratio no one thought could be possible without catastrophic economic consequences. But this high and rising ratio is made possible because Japanese families are apparently willing to lend their government unlimited funds at zero interest.

For decades we have been told that

we are running out of oil. Now we are

told there is too much oil. Proven reserves

have been greatly increased and because of improving drilling technology oil

can be extracted at lower and lower marginal and average cost.

For four decades, Americans have

been told that nuclear energy is bad and dangerous. Now the world is planning on building

hundreds of nuclear power plants using new technology. This is a major strategy to reduce global

warming. But not in the United States.

Electric engines in cars will reduce carbon emissions and slow global warming. Unless the electricity is generated by burning coal or other fossil fuels.

Electric engines in cars will reduce carbon emissions and slow global warming. Unless the electricity is generated by burning coal or other fossil fuels.

The world faced a Malthusian future

of exponential population growth caused by high birth rates, not enough food, and

the depletion of energy and natural resources.

Since then, most of the world has birth rates below replacement and the

rest of the world has falling birth rates. Industrial countries worry about

future declining populations and labor forces.

Food production has undergone a series of technological revolutions that

has greatly increased the quantity, if not the quality, of food. Energy resources are almost unlimited with

even more technological revolutions on the horizon.

Since the 1950s, Americans have been

hearing how other forms of political economy would overcome the U.S. First Russia, then Germany, then Japan, then

the Four Dragons of Asia. Behind all these predictions was the description

of the advantages of socialism or state capitalism over our relatively autonomous

capitalism. Commentators suggested we

adopt some of the government planning policies of these countries. We didn’t. These countries and their economic systems

turned out not to be a threat to us but they are a warning to China.

MORE CONVENTIONAL WISDOM

Red wine, dark chocolate, and beer were bad for your health. Now they are health foods. This is my idea of progress!

Red wine, dark chocolate, and beer were bad for your health. Now they are health foods. This is my idea of progress!

Comments

Post a Comment